Tue, 26 Aug 2025 08:51:12 -0500

ABSTRACT

This guideline focuses on identity proofing and enrollment for use in digital authentication. During the process of identity proofing, an applicant provides evidence to a credential service provider (CSP) reliably identifying themselves, thereby allowing the CSP to assert that identification at a useful identity assurance level. This document defines technical requirements for each of three identity assurance levels. The guidelines are not intended to constrain the development or use of standards outside of this purpose. This publication supersedes NIST Special Publication (SP) 800-63A.

Keywords

authentication; credential service provider; digital authentication; identity proofing; federation.

Preface

This document and associated companion volumes — [SP800-63], [SP800-63B], and [SP800-63C] — provide guidance to organizations on the processes and technologies for managing digital identities at designated levels of assurance.

This document provides requirements for the identity proofing of individuals at each identity assurance level (IAL) for the purposes of enrolling them into an identity service or providing them access to online resources. It applies to the identity proofing of individuals over a network or in person.

Introduction

This section is informative.

One of the challenges of providing online services is being able to associate a set of activities with a single known individual. Situations in which it is important to reliably establish an association with a real-life subject include accessing sensitive government services, executing financial transactions, when required by regulation (e.g., the financial industry’s Customer Identification Program requirements), and when needed to establish accountability for high-risk actions (e.g., changing the release rate of water from a dam).

These guidelines define identity proofing as the process of establishing a relationship between a subject accessing online services and a real-life person to some degree of assurance. For the purposes of this document, the terms “subject” and “person” refer only to natural persons, not non-person entities, organizations, or things. This document provides guidance for federal agencies, third-party Credential Service Providers (CSPs), and other organizations that provide or use identity proofing services.

Expected Outcomes of Identity Proofing

The expected outcomes of identity proofing include:

- Identity resolution: Determine that the claimed identity corresponds to a single, unique individual within the context of the population of users served by the CSP or online service.

- Evidence validation: Confirm that supplied identity evidence is genuine, authentic, and accurate.

- Attribute validation: Confirm the accuracy of the core attributes, which are the minimum set of attributes required to complete identity proofing and provide services.

- Identity verification: Confirm that the applicant is the genuine owner of the presented evidence and attributes.

- Identity enrollment: Enroll the identity-proofed applicant into the CSP’s identity service as a subscriber.

- Fraud mitigation: Detect, respond to, and prevent access to benefits, services, data, or assets using a fraudulent identity.

Identity proofing services are expected to incorporate privacy-enhancing principles (e.g., data minimization) and employ good usability practices to minimize the burden on applicants while still accomplishing the expected outcomes.

Identity Assurance Levels

Assurance (confidence) in a subscriber’s identity is established using the processes associated with the identity assurance levels (IAL) defined in these guidelines. Each successive IAL builds on the requirements of lower IALs in order to achieve increased assurance.

No identity proofing: There is no requirement to link the applicant to a specific, real-life person. Evidence collection is not required; attributes may or may not be validated; and identity verification is not conducted. This does not exclude attributes from being validated as part of other business processes, but attribute validation is not required for access.

IAL1: The identity proofing process supports the real-world existence of the claimed identity and provides some assurance that the applicant is associated with that identity. Core attributes are obtained from identity evidence or self-asserted by the applicant. All core attributes (see Sec. 2.2) are validated against authoritative or credible sources, and steps are taken to confirm that the attributes are associated with the person undergoing the identity proofing process. Identity proofing is performed using remote or on-site processes, with or without the attendance of a CSP representative. Upon the successful completion of identity proofing, the applicant is enrolled into a subscriber account and any authenticators can then be bound to the account, including subscriber-provided authenticators. IAL1 is designed to limit highly scalable attacks (e.g., automated enrollment attacks) and to protect against synthetic identities and attacks using compromised personal information.

IAL2: IAL2 requires collecting additional evidence and more rigorous processes for validating evidence and verifying identities, including enhanced processes to confirm that the applicant is the rightful owner of the presented evidence. Like IAL1, identity proofing at IAL2 can be performed using remote or on-site processes, with or without the attendance of a CSP representative. In addition to those threats addressed by IAL1, IAL2 is designed to limit scaled and targeted attacks and to protect against basic evidence falsification, evidence theft, and social engineering tactics.

IAL3: IAL3 adds the requirements for a trained CSP representative (i.e., proofing agent) to interact directly with the applicant as part of an on-site attended identity proofing session and the collection of at least one biometric characteristic. The successful on-site identity proofing session concludes with the enrollment of the applicant into a subscriber account and the delivery of one or more authenticators bound to that account. IAL3 is designed to limit more sophisticated attacks, and protect against advanced evidence falsification, theft, repudiation, and more advanced social engineering tactics.

\clearpage

Notations

This guideline uses the following typographical conventions in text:

- Specific terms in CAPITALS represent normative requirements. When these same terms are not in CAPITALS, the term does not represent a normative requirement.

- The terms “SHALL” and “SHALL NOT” indicate requirements to be followed strictly in order to conform to the publication and from which no deviation is permitted.

- The terms “SHOULD” and “SHOULD NOT” indicate that among several possibilities, one is recommended as particularly suitable without mentioning or excluding others, that a certain course of action is preferred but not necessarily required, or that (in the negative form) a certain possibility or course of action is discouraged but not prohibited.

- The terms “MAY” and “NEED NOT” indicate a course of action permissible within the limits of the publication.

- The terms “CAN” and “CANNOT” indicate a possibility and capability — whether material, physical, or causal — or, in the negative, the absence of that possibility or capability.

Document Structure

This document is organized as follows. Each section is labeled as either normative (i.e., mandatory for compliance) or informative (i.e., not mandatory).

- Section 1 introduces the document. This section is informative.

- Section 2 describes requirements for identity proofing. This section is normative.

- Section 3 describes general requirements for IALs. This section is normative.

- Section 4 describes requirements for specific IALs. This section is normative.

- Section 5 describes subscriber accounts. This section is normative.

- Section 6 provides security considerations. This section is informative.

- Section 7 provides privacy considerations. This section is informative.

- Section 8 provides customer experience considerations. This section is informative.

- The References section contains a list of publications that are cited in this document. This section is informative.

- Appendix A provides a non-exhaustive list of types of identity evidence grouped by strength. This appendix is informative.

- Appendix B contains a selected list of abbreviations used in this document. This appendix is informative.

- Appendix C contains a glossary of selected terms used in this document. This appendix is informative.

- Appendix D contains a summarized list of changes in this document’s history. This appendix is informative.

Identity Proofing Overview

This section is normative.

This section provides an overview of the identity proofing and enrollment process, as well as requirements to support the resolution, validation, and verification of the identity claimed by an applicant. It also provides guidelines on additional aspects of the identity proofing process. These requirements are intended to ensure that the claimed identity exists in the real world and that the applicant is the individual associated with that identity.

These guidelines provide multiple methods by which resolution, validation, and verification can be accomplished, as well as multiple types of identity evidence that support the identity proofing process. CSPs and organizations SHOULD provide options when implementing their identity proofing services and processes to promote access for applicants with different means, capabilities, and technologies. These options SHOULD include accepting multiple types and combinations of identity evidence, supporting multiple data validation sources, enabling multiple methods for verifying identity, providing multiple identity proofing types, and offering exception handling for applicants (e.g., trusted referees, applicant references).

CSPs SHALL evaluate the risks associated with each identity proofing option offered (e.g., identity proofing types, validation sources, assistance mechanisms) and implement mitigating fraud controls, as appropriate. At a minimum, CSPs SHALL design each option such that the options provide comparable assurance in aggregate.

Requirements are typically expressed in these guidelines as responsibilities of the CSP unless otherwise noted. CSP requirements may be performed by a single entity or may include several component services so that all CSP responsibilities are fulfilled.

Identity Proofing and Enrollment

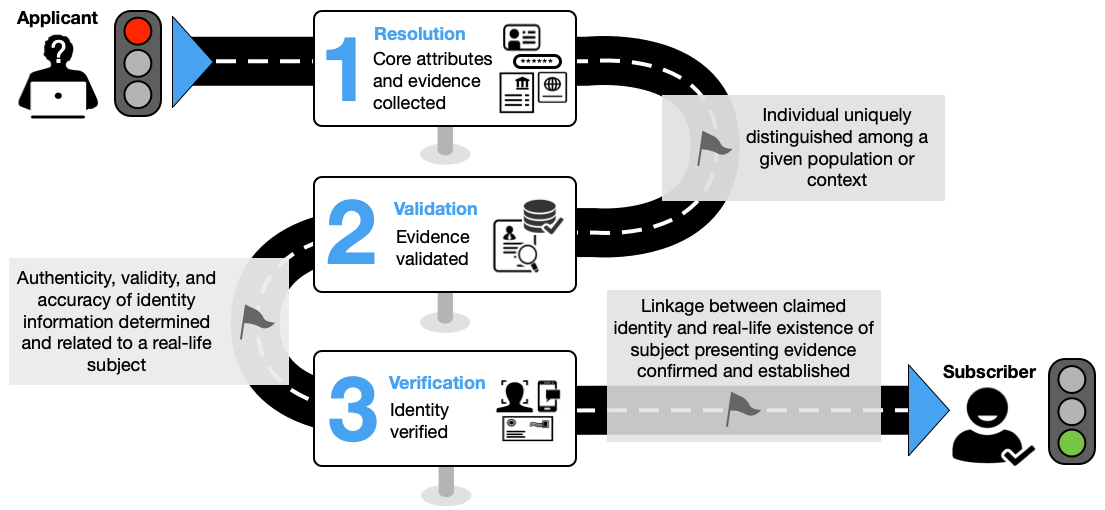

The intent of identity proofing is to ensure that the applicant involved in the identity proofing process is who they claim to be to a stated level of confidence. This document presents a three-step process for CSPs to identity-proof applicants at designated assurance levels. The first step is identity resolution, which consists of collecting appropriate identity evidence and attribute information to determine whether the applicant is a unique identity in the population served by the CSP and a real-life person. The second step is identity validation, which confirms the authenticity, accuracy, and validity of the evidence and attribute information collected in the first step. The third step is identity verification, which confirms that the applicant presenting the identity evidence is the same individual to whom the evidence was issued. In most cases, upon successfully identity proofing an applicant to the designated IAL, the CSP establishes a unique subscriber account for the applicant (now a subscriber in the identity service), which allows one or more authenticators to be bound to the proven identity in the account.

Identity proofing can be part of an organization’s business processes to determine the suitability or entitlement to a benefit or service, though such determinations are outside of the scope of these guidelines.

Process Flow

This subsection is informative.

Figure 1 provides an illustrative example of the three-step identity proofing process.

Fig. 1. Identity proofing process

The following steps present a common workflow example of remote unattended identity proofing and are not intended to represent a normative processing workflow model.

-

Resolution

- The CSP collects one or two pieces of identity evidence of appropriate strength.

- The CSP collects any additional core attributes, as needed, from the applicant to supplement those contained in the presented identity evidence.

-

Validation

- The CSP confirms that the presented evidence is authentic, accurate, and valid.

- The CSP validates the attributes obtained in step 1 by checking them against authoritative or credible validation sources, as described in Sec. 2.4.2.4.

-

Verification

- The CSP employs an approved identity verification process to confirm that the applicant is the genuine owner of the presented identity evidence.

-

Enrollment

Upon the successful completion of the three identity proofing steps, a notification of proofing is sent to a validated address, and the applicant can be enrolled into a subscriber account with the CSP, as described in Sec. 5. A subscriber account includes at least one validated address (e.g., phone number, mailing address) that can be used to communicate with the subscriber about their account. Additionally, one or more authenticators are bound to the proven identity in the subscriber account.

Identity Proofing Roles

Different individuals can play different roles within the proofing process. To support the consistent implementation of these guidelines, the following identity proofing roles are defined:

- Proofing agent: An agent of the CSP who is vetted and trained to attend on-site or remote identity proofing sessions and make limited, risk-based decisions (e.g., visually inspecting identity evidence and determining it has not been altered). See Sec. 3.13 for minimum training requirements for proofing agents.

- Trusted referee: An agent of the CSP, a third-party service, or a relying party (RP) who is vetted and trained to make risk-based decisions regarding an applicant’s identity proofing case when that applicant is unable to meet the expected requirements of a defined IAL proofing process. Requirements for trusted referees are contained in Sec. 3.15.1. In contrast to proofing agents, trusted referees receive additional training and resources to support exception handling scenarios, including when applicants do not possess the required identity evidence or the attributes on the evidence do not all match the claimed identity (e.g., due to a recent name or address change).

- Applicant reference: A representative of the applicant who can vouch for the identity of the applicant, specific attributes related to the applicant, or conditions relative to the context of the individual (e.g., emergency status, homelessness). An applicant reference does not act on behalf of the applicant in the identity proofing process but can support claims of identity. Requirements for applicant references are contained in Sec. 3.15.3.

- Process assistant: An individual who provides support services (e.g., translation, transcription, or accessibility support) to assist the applicant in the identity proofing process but does not support decision-making or risk-based evaluation. Since the process assistant is not involved in decision-making there are no requirements in these guidelines for this role.

CSPs SHALL identify which of the above roles are applicable to their identity service and SHALL provide training and support resources consistent with the requirements and expectations provided in Sec. 3.

Identity Proofing Types

For the purposes of this document, identity proofing types are defined by the combination of technologies, communication channels, and identity proofing roles employed by a CSP. Identity proofing types are characterized based on two factors: where the identity proofing takes place and whether the process is attended by an agent of the CSP.

- Remote unattended identity proofing: Identity proofing conducted where the resolution, validation, and verification processes are completely automated, and interaction with a proofing agent or trusted referee is not required. The location and devices used in the proofing process are not controlled by the CSP.

- Remote attended identity proofing: Identity proofing conducted where the applicant completes resolution, validation, and verification steps through a secure video session with a proofing agent or trusted referee. The location and devices used in the proofing process are not controlled by the CSP.

- On-site unattended identity proofing: Identity proofing conducted where an individual interacts with a controlled workstation or kiosk, but interaction with a proofing agent or trusted referee is not required. The process is fully automated but at a physical location and on devices controlled by the CSP.

- On-site attended identity proofing: Identity proofing conducted in a physical setting where the applicant completes the entire identity proofing process (i.e., resolution, validation, and verification) in the presence of a proofing agent or trusted referee. The proofing agent or trusted referee can be co-located with the user or interact with the user via a kiosk or device. The physical location and devices are controlled by the CSP.

The requirements at each assurance level are structured to allow CSPs to implement different combinations of identity proofing types to meet the requirements of different assurance levels, as appropriate. CSPs SHOULD offer the combination of identity proofing types that best addresses the needs of the populations served by their identity service and the risk posture of the RPs that use their service.

Core Attributes

The identity proofing process involves the presentation and validation of the minimum attributes necessary to accomplish identity proofing, including what is needed to complete resolution, validation, and verification. The CSP determines and documents the set of attributes that it considers to be core attributes, as specified in Sec. 3.1. CSPs SHALL include a government identifier1 and SHOULD include the following in their set of core attributes for identity proofing at any IAL:

- First name: The applicant’s given name.

- Middle name or initial: The applicant’s middle name or initial, as applicable.

- Last name: The applicant’s last name or family name, as appropriate.

- Date of birth: The date on which the applicant was born.

- Physical or digital address: A physical (i.e., mailing address) or digital (e.g., phone number or email) address at which the applicant can receive communications related to the proofing process.

Additional attributes MAY be added to these as required by the CSP and RP. The CSP and RP SHALL document all core attributes in trust agreements and practice statements. Following a privacy risk assessment, a CSP MAY request additional attributes that are not required to complete identity proofing, but that may support other RP business processes. See Sec. 3.3 for details on privacy requirements for requesting additional attributes.

Identity Resolution

Identity resolution involves the CSP’s collection of the minimum amount of identity evidence and attribute information that is needed for identity proofing and to distinguish a unique identity in the population served. Identity resolution is the starting point in the overall identity proofing process, including the initial detection of potential fraud.

Identity Evidence and Attributes

Identity evidence is information or documentation that supports the real-world existence of the claimed identity. Identity evidence may be physical (e.g., a driver’s license) or digital (e.g., a mobile driver’s license or digital assertion).

Identity evidence collection supports the identity validation process and consists of two steps: 1) the presentation of identity evidence by the identity proofing applicant to the CSP and 2) the determination by the CSP that the presented evidence meets the applicable strength requirements.

Evidence Strength Requirements

This section defines the requirements for identity evidence at each strength. The strength of a piece of identity evidence is determined by:

- The level of rigor associated with its issuance process

- The ability to be validated to a given level of confidence, including accuracy and authenticity checks

- The ability to support one or more of the identity verification methods presented in Sec. 2.5.1

Appendix A of this document provides a non-exhaustive list of possible evidence types grouped by strength.

Fair Evidence Requirements

To be considered FAIR, identity evidence SHALL meet all of the following requirements:

- There is a reasonable expectation that the issuing source of the evidence confirmed the claimed identity by following formal procedures designed to provide assurance that the claimed identity is associated with the subject, such as evidence issued by financial institutions that have customer identity verification obligations under the Customer Identification Program (CIP) rule or procedures for establishing a mobile phone account with a mobile network operator (MNO).

- The evidence has an issuance process that results in the delivery of the evidence to the person to whom it relates, such as delivery to a postal address, issuance in person, or through a protected remote provisioning process.

- The evidence contains the name of the claimed identity.

- The evidence contains at least one reference number, a facial image or other biometric characteristic, or sufficient attributes to uniquely identify the person to whom it relates.

- The evidence contains physical (e.g., security printing, optically variable features, holograms) or digital (e.g., digitally signed assertions, addressable SIM or ESIM) security features that make it difficult to reproduce.

- Core attributes on the evidence can be validated against information held by an authoritative or credible source, as described in Sec. 2.4.2.4.

- The evidence can be validated through an approved method, as provided in Sec. 2.4.2.2.

- The evidence can support the identity verification process, as described in Sec. 2.5.1.

Strong Evidence Requirements

In order to be considered STRONG, identity evidence SHALL meet all of the following requirements:

- There is a reasonable expectation that the issuing source of the evidence confirmed the claimed identity by following written procedures (e.g., identity proofing at IAL2 or above) designed to provide assurance that the claimed identity is associated with the subject. Additionally, these procedures are subject to recurring oversight by regulatory or publicly accountable institutions, such as states, the Federal Government, and some regulated industries.

- The evidence has an issuance process that results in the delivery of the evidence to the person to whom it relates, such as delivery to a postal address, issuance in person, or through a protected remote provisioning process.

- The evidence contains the name of the claimed identity.

- The evidence contains a reference number or other attributes that uniquely identify the person to whom it relates.

- The evidence contains a facial image or other biometric characteristic of the person to whom it relates.

- The evidence contains physical (e.g., security printing, optically variable features, holograms) or digital security (e.g., digitally signed assertions, addressable SIM or ESIM) features that make it difficult to reproduce.

- Core attributes on the evidence can be validated against information held by authoritative or credible sources, as described in Sec. 2.4.2.4.

- The evidence can be validated through an approved method, as provided in Sec. 2.4.2.2.

- The evidence can support the identity verification process, as described in Sec. 2.5.1.

Superior Evidence Requirements

In order to be considered SUPERIOR, identity evidence SHALL meet all of the following requirements:

- The issuing source of the evidence confirmed the claimed identity by following written procedures (e.g., identity proofing at IAL2 or above) designed to enable it to have high confidence that the claimed identity is associated with the subject. Additionally, these procedures are subject to recurring oversight by regulatory or publicly accountable institutions, such as states, the Federal Government, and some regulated industries.

- The identity evidence contains attributes and data objects that are cryptographically protected and can be validated using approved cryptography through verification of a digital signature applied by the issuing source.

- The issuing source had the subject participate in an attended enrollment and identity proofing process that confirmed their physical existence.

- The evidence has an issuance process that results in the delivery of the evidence to the person to whom it relates, such as delivery to a postal address, issuance in person, or through a protected remote provisioning process.

- The evidence contains the name of the claimed identity.

- The evidence contains at least one reference number that uniquely identifies the person to whom it relates.

- The evidence contains a facial image or other biometric characteristic of the person to whom it relates.

- The evidence contains physical (e.g., security printing, optically variable features, holograms) or digital security (e.g., digitally signed assertions, addressable SIM or ESIM) features that make it difficult to reproduce.

- The evidence can be validated through an approved method, as provided in Sec. 2.4.2.2.

- The evidence can support the identity verification process, as described in Sec. 2.5.1.

Identity Evidence and Attribute Validation

The goal of identity evidence validation is to determine that the collected identity evidence is genuine and valid. The goal of attribute validation is to confirm the accuracy of all the core attributes.

This document uses the term “valid” to recognize that evidence can remain a useful means to prove identity, even if it is expired or was issued outside of a determined time frame. CSPs define their policy for addressing expired evidence as part of the CSP practice statement described in Sec. 3.1, and RPs determine whether this is acceptable for accessing their online services.

Identity evidence validation involves examining the presented evidence to confirm that it is authentic (i.e., not forged or altered), accurate (i.e., the information on the evidence is correct), and valid (i.e., unexpired or within the CSP’s defined timeframe for issuance or expiration). Attribute validation involves confirming the accuracy of the core attributes, whether obtained from presented evidence or self-asserted. The following subsections provide acceptable methods for evidence and attribute validation.

Evidence Validation

The CSP SHALL validate the authenticity, accuracy, and validity of presented evidence by confirming that:

- The evidence is in the correct format and includes complete information for the identity evidence type

- The evidence does not show signs of being counterfeit or tampered with

- The evidence contains physical or digital security features

- The core attributes and data fields necessary to determine authenticity on the evidence are accurate

Evidence Validation Methods

Acceptable methods for validating presented evidence are:

- Visual and tactile inspection by trained personnel for on-site identity proofing

- Visual inspection by trained personnel for remote identity proofing

- Automated document validation processes using appropriate technologies

- Cryptographic verification of the source and integrity of digital evidence or attribute data objects

For some digital evidence (e.g., MNO/phone accounts), there is not a physical piece of evidence that can be validated visually or physically. Authenticity is confirmed by validating the identity attributes associated with that account and phone number with an issuing or credible source, such as by validating a digitally signed assertion from the issuer or querying an attribute validation service with access to that account information.

Attribute Validation

The CSP SHALL validate all core attributes (Sec. 2.2), whether obtained from identity evidence or self-asserted by the applicant, with an authoritative or credible source (Sec. 2.4.2.4).

Validation Sources

The CSP SHALL use authoritative or credible sources that meet the following criteria.

An authoritative source is the issuing source of identity evidence or attributes or has direct access to the information maintained by issuing sources. Examples of issuing sources include state departments of motor vehicles for driver’s license data and the Social Security Administration for Social Security cards and numbers. An example of an authoritative source that provides or enables direct access to issuing sources is the American Association of Motor Vehicle Administrators’ Driver’s License Data Verification (DLDV) Service.

A credible source has access to attribute information that can be traced to an authoritative source or maintains identity attribute information obtained from multiple sources that is correlated for accuracy, consistency, and currency. Credible sources are subject to regulatory oversight (e.g., the Fair Credit Reporting Act).

Identity Verification

The goal of identity verification is to establish the linkage between the claimed validated identity and the real-life applicant engaged in the identity proofing process to a specified level of confidence. In other words, verification provides assurance that the applicant presenting the evidence is the rightful owner of that evidence.

Identity Verification Methods

The CSP SHALL verify the linkage between the claimed identity to the applicant engaged in the identity proofing process through one or more of the following methods.

- Confirmation code verification: The individual is able to demonstrate control of a piece of identity evidence through the return of a confirmation code, consistent with the requirements specified in Sec. 3.8.

- Authentication and federation protocols: The individual is able to demonstrate control of a digital account (e.g., online bank account) or signed digital assertion through the use of authentication or federation protocols. This can be done in person, through presentation of the credential to a device or reader, or during a remote identity proofing session.

- Transaction verification: An individual is able to demonstrate control of a piece of evidence by returning a value based on a microtransaction made between the CSP and the issuing source of the evidence (e.g., a micro-deposit to verify ownership of a financial account).

- Visual facial image comparison — on-site attended: The proofing agent and applicant interact directly during the identity proofing process. The proofing agent performs a visual comparison of the facial image presented on identity evidence to the face of the applicant engaged in the identity proofing event.

- Visual facial image comparison — remote attended or remote unattended: The proofing agent performs a visual comparison of the facial image presented on identity evidence or stored by the issuing source to the facial image of the applicant engaged in the identity proofing event. The proofing agent may interact directly with the applicant during some or all of the identity proofing process or may conduct the comparison at a later time using a captured video or photograph and the uploaded copy of the evidence.

- Automated biometric comparison: Automated biometric comparison (e.g., facial recognition or other fully automated algorithm-driven biometric comparison) can be performed for onsite or remote identity proofing events. The facial image or other biometric characteristic (e.g., fingerprints, palm prints, iris and retina patterns, voiceprints, vein patterns) on the identity evidence or stored in authoritative records is compared to the equivalent biometric sample collected from the applicant during the identity proofing event.

Knowledge-based verification (KBV) or knowledge-based authentication SHALL NOT be used for identity verification.

-

A government identifier is a unique identifier that is associated with the applicant in government records (e.g., Social Security number, driver’s license number, passport number). ↩

Identity Proofing Requirements

This section is normative.

This section provides requirements for CSPs that operate identity proofing and enrollment services, including requirements for identity proofing at each of the IALs. This section also includes additional requirements for federal agencies, regardless of whether they operate their own identity service or use an external CSP.

Sections 4.1, 4.2, and 4.3 provide the requirements and guidelines for identity proofing at a specific IAL. Section 4.4 includes a summarized list of these requirements by IAL in Table 1.

Identity Service Documentation and Records

The CSP SHALL conduct its operations according to documented procedures or a practice statement that details all identity proofing processes as they are implemented to achieve the defined IAL. These documented procedures SHALL include, at a minimum:

- A complete service description, including the particular steps that the CSP follows to identity-proof applicants at each offered assurance level

- The CSP’s policy for providing notice to applicants about the types of identity proofing processes available, the evidence and attribute collection requirements for the IALs offered by the CSP, the purpose for collecting personal information (see Sec. 3.3.2), and the purposes for collecting, using, and retaining biometrics (see Sec. 3.1.11)

- The CSP’s policy for ensuring that the identity proofing process concludes in a timely manner once the applicant has met all of the requirements

- The types of evidence that the CSP accepts and the justification for how the evidence fulfills the strength requirements of the level at which it will be accepted by the CSP

- The CSP’s policy and process for validating and verifying identity evidence, including training and qualification requirements for personnel who serve in identity proofing roles, as provided in Sec. 2.1.2

- The specific technologies that the CSP employs for evidence validation and verification

- The CSP’s policy and processes for supporting applicants who lack sufficient identity evidence for the required IAL (Sec. 3.15) and for addressing identity proofing exceptions and errors

- The attributes that the CSP considers to be core attributes (Sec. 2.2) and the authoritative and credible sources it uses for validating those attributes (Sec. 2.4.2.4)

- The CSP’s policy for managing and communicating service changes to RPs, such as changes in data sources, integrated vendors, or biometric algorithms

- The CSP’s approach to fraud management (see Sec. 3.2), including its policy and process for identifying and remediating suspected or confirmed fraudulent accounts and communicating such information to RPs and affected individuals

- The CSP’s policy for any conditions that would require reverification of the user (e.g., account recovery, account abandonment, regulatory “recertification” requirements)

- The CSP’s policy for conducting privacy risk assessments, including the timing of its periodic reviews and specific conditions that will trigger an updated privacy risk assessment (see Sec. 3.3.1)

- The CSP’s policy for assessing customer experience, including the testing methods employed, timing of its periodic reviews, and any specific conditions that will trigger an out-of-cycle review (see Sec. 3.4)

- The CSP’s policy for the retention, protection, and deletion of all personal, sensitive, and biometric data, including the treatment of all such data if the CSP ceases operation or merges or transfers operations to another CSP

- The CSP’s policy for reporting and updating performance metrics, as described in Sec. 3.5.2 of SP 800-63

- The CSP’s policy for accessing or removing a subscriber’s account in the event of their death or incapacitation (see Sec. 5)

CSPs SHALL make their documented procedures or practice statements available to RPs that use their identity service. CSPs SHOULD make a summarized version of their documented procedures or practice statements publicly available.

SP 800-63C describes the use of trust agreements to define requirements between an identity provider (IdP), CSP, and RP in a federated relationship. CSP practice statements MAY be included directly in these agreements.

Fraud Management

A critical aspect of the identity proofing process is to mitigate fraudulent attempts to gain access to benefits, services, data, or assets that are protected by identity management systems. Resolution, validation, and verification processes are designed to mitigate many types of attacks. However, with the constantly changing threat environment, layering additional checks and controls can provide increased confidence in proofed identities and additional protections against advanced and emerging types of attacks. The ability to identify, detect, and resolve instances of potential fraud is a critical functionality for CSPs and RPs.

CSP Fraud Management

- CSPs SHALL establish and maintain a fraud management program that provides fraud identification, detection, investigation, reporting, and resolution capabilities. The specific capabilities and details of this program SHALL be documented within their CSP practice statement.

- CSPs SHALL conduct a privacy risk assessment of all fraud checks and fraud mitigation technologies prior to implementation.

- The CSP SHALL establish a self-reporting mechanism and investigation capability for subjects who believe they have been the victim of fraud or an attempt to compromise their involvement in the identity proofing processes.

- CSPs SHALL analyze all remote proofing communication channels to look for high-risk indicators (e.g., blocklisted proxies and IP addresses).

- The CSP SHALL take measures to prevent unsuccessful applicants from inferring the accuracy of any self-asserted information with that confirmed by authoritative or credible sources.1

- CSPs SHALL monitor the performance of their fraud checks and fraud mitigation technologies to ensure continued effectiveness in mitigating fraud risks.

- CSPs SHALL establish a technical or process-based mechanism to communicate suspected and confirmed fraudulent events to RPs.

- CSPs SHALL implement a death records check for all identity proofing processes by confirming with a credible, authoritative, or issuing source that the applicant is not deceased. Such checks can aid in preventing synthetic identity fraud, the use of stolen identity information, and exploitation by a close associate or relative.

- CSPs SHOULD implement the following fraud checks for their identity proofing processes based on their available identity proofing types, selected technologies, evidence, and user base:

- SIM swap detection: Confirm that the phone number used in the identity proofing process has not been recently ported to a new user or device. Such checks can provide an indication that a phone or device was compromised by a targeted attack.

- Device or account tenure check: Evaluate the length of time a phone service subscription or other account (e.g., email account) has existed without substantial modifications or changes. Such checks can provide additional confidence in the reliability of a device or piece of evidence used in the identity proofing process.

- Mailing address check: Determine whether the mailing address is a known virtual Post Office (PO) Box or has other high-risk characteristics.

- Device fingerprinting: Incorporate device fingerprinting checks to protect against scaled and automated attacks and enrollment duplication. Device fingerprinting is the process of collecting and analyzing the hardware and software characteristics of a device in order to create a unique identifier (i.e., fingerprint) for the device.

- Transaction analytics: Evaluate anticipated transaction characteristics (e.g., IP addresses, geolocations, transaction velocities) to identify anomalous behaviors or activities that can indicate a higher risk or a potentially fraudulent event. Fraud velocity checks monitor the frequency and pattern of transactions over a specific period of time to identify unusual activity associated with transaction data. Such checks can protect against scaled and automated attacks, as well as indicate whether specific attack patterns are being executed on identity systems.

- Fraud indicator check: Evaluate records (e.g., reported, confirmed, or historical fraud events) to determine whether there is an elevated risk related to a specific applicant, applicant’s data, or device. Such checks can indicate identity theft or compromise. Where such information is collected, aggregated, or exchanged across commercial platforms and made available for use by RPs and other CSPs, users SHALL be made aware of any privacy implications based on a privacy risk assessment. This also applies to all websites that report user activity to federal RPs.

- CSPs SHOULD periodically employ independent testing (e.g., red teaming exercises) to validate the effectiveness of their fraud mitigation measures.

- CSPs SHOULD consider the recency of fraud-related data when factoring such data into fraud prevention capabilities and decisions.

- For attended proofing processes, CSPs SHALL train proofing agents to detect indicators of fraud and SHALL provide proofing agents and trusted referees with tools to flag suspected fraudulent events for further treatment and investigation.

- Collusion is possible whenever CSP representatives are directly involved in proofing processes or decisions. CSPs SHALL implement insider threat controls to detect and prevent collusion involving CSP representatives that are directly involved with or can intervene in proofing processes or decisions.

- CSPs SHOULD communicate fraud events in real time to RPs through methods such as shared signaling, as described in Sec. 4.8 of [SP800-63C].

- CSPs MAY employ KBV as part of its fraud management program.

- CSPs MAY implement fraud mitigation measures as compensating controls. When this is done, these SHALL be documented as deviations from the normative guidance of these guidelines and SHALL be conveyed to all RPs through a Digital Identity Acceptance Statement (DIAS) prior to integration. See Sec. 3.4.4 of [SP800-63] for more information about the DIAS.

CSPs that employ artificial intelligence (AI) or machine learning (ML) as part of their identity service SHALL adhere to the requirements provided in Sec. 3.8 of [SP800-63], as applicable.

RP Fraud Management

- RPs SHALL establish a point of contact with whom CSPs can interact and communicate fraud data.

- RPs SHALL conduct a privacy risk assessment (see Sec. 3.3.1) of any CSP fraud checks and mitigation technologies to identify potential privacy risks or unintended harms. Federal agency RPs SHALL implement this consistent with the requirements contained in Sec. 3.7.

- RPs SHOULD include any requirements for fraud checks and fraud mitigation technologies in trust agreements with their CSPs.

- RPs SHALL conduct periodic reviews of their CSP’s fraud management program, fraud checks, and fraud technologies to adjust thresholds, review investigations into fraud events, and evaluate the effectiveness and efficacy of fraud controls.

- RPs SHALL review all fraud mitigation measures that have been deployed as compensating or supplemental controls by CSPs to align with their internal risk tolerance and acceptance. The RP SHALL record the CSP’s compensating controls in their own DIAS prior to integration.

- Pursuant to applicable laws and regulations, RPs SHOULD establish a mechanism to communicate the outcomes of fraud reports and investigations, including both positive and negative results, to CSPs and other partners in order to allow them to improve their own fraud identification, mitigation, and reporting capabilities.

- RPs SHOULD establish a fraud management program for digital identity management consistent with their mission, regulatory environment, systems, applications, data, and resources.

- Informed by risks identified in a privacy risk assessment, the RP MAY also request additional attributes beyond what a CSP provides as its core attributes to combat fraud or to support other business processes.

Treatment of Fraud Check Failures

The effectiveness of fraud checks and mitigation technologies will vary based on numerous contributing factors, including the data sources used, the technologies used, and — perhaps most importantly — the applicant population. Therefore, it is critical to have well-structured and documented processes addressing failures that arise from the fraud management measures. The following requirements apply to handling these failures:

- CSPs SHALL establish and document actions and practices related to each of their fraud checks and provide these actions and practices to RPs.

- CSPs SHALL establish procedures for redress to allow applicants to resolve issues associated with fraud checks and mitigation technologies. See Sec. 3.6 of [SP800-63] for more information about redress.

- The CSP SHOULD offer trusted referee services to applicants who fail fraud checks in unattended remote processes. If trusted referees are offered to applicants who fail fraud checks in unattended remote processes, the trusted referees SHALL be provided with a summary of the results of the fraud failures to inform their risk-based decision-making processes.

General Privacy Requirements

The following privacy requirements apply to all CSPs that provide identity services at any IAL.

Privacy Risk Assessment

- The CSP SHALL conduct and document a privacy risk assessment for the processes used for identity proofing and enrollment.2 At a minimum, the privacy risk assessment SHALL assess the risks associated with:

- Processing personal information for the purposes of identity proofing, enrollment, or fraud management, including identity attributes, biometrics, images, video, scans, or copies of identity evidence

- Additional steps that the CSP takes to verify the identity of an applicant beyond the mandatory requirements specified herein

- Processing of personal information for purposes outside of the scope of identity proofing and enrollment, except to comply with law or legal processes

- The retention schedule for identity records and personal information

- Processing non-personal information that could be used to identify a person when aggregated or processed by an algorithm (e.g., AI or ML tools)

- Personal information that is processed by a third-party service on behalf of the CSP

- Based on the results of its privacy risk assessment, the CSP SHALL document the measures it takes to maintain the disassociability, predictability, manageability, confidentiality, integrity, and availability of any personal information it collects or processes.3 In determining such measures, the CSP SHOULD apply relevant guidance and standards, such as the NIST Privacy Framework [NIST-Privacy] and NIST SP 800-53 [SP800-53].

- The CSP SHALL reassess privacy risks and update its privacy risk assessment any time it makes changes to its identity service that affect the processing of personal information.

- The CSP SHALL review its privacy risk assessment periodically, as documented in its practice statement, to ensure that it accurately reflects the current risks associated with the collection and processing of personal information.

- The CSP SHALL make a summary of its privacy risk assessment available to any RPs that use its services. The summary SHALL be in sufficient detail to enable such RPs to make reasonable determinations about privacy risks associated with the CSPs services and to complete their own privacy risk assessments.

- The CSP SHALL perform a privacy risk assessment for the processing of any personal information maintained in subscriber accounts (see Sec. 5).

Additional Privacy Protective Measures

- The processing of personal information SHALL be limited to the minimum necessary to validate the existence of the claimed identity, associate the claimed identity with the applicant, mitigate fraud, and provide RPs with attributes that they may use to make authorization decisions.

- The CSP SHALL provide privacy training to all personnel and any third-party service providers who have access to sensitive information associated with the CSP’s identity service.

- The CSP MAY collect a Social Security number (SSN) as an attribute when necessary for identity resolution. Knowledge of an SSN is not sufficient to act as evidence of identity, nor is it considered an acceptable method of verifying possession of the Social Security card when used as evidence. If the SSN is collected on behalf of a federal, state, or local government agency, the CSP SHALL provide notice to the applicant for the collection in accordance with applicable laws.

- At the time of collection, the CSP SHALL provide explicit notice to the applicant regarding the purpose for collecting any attributes and personal information. Such a notice SHALL include whether the personal information and attributes are voluntary or mandatory to complete the identity proofing process, the specific attributes and other sensitive data that the CSP intends to store in the applicant’s subsequent subscriber account, the consequences of not providing the attributes, and the details of any records retention requirement if one is in place, including an applicant’s right to request data deletion or engage in other forms of redress.

- CSPs SHOULD implement techniques that protect an applicant’s privacy based on the privacy considerations in Sec. 7.

General Customer Experience Requirements

CSPs assess the elements of their identity services to identify processes and technologies that may result in customer experience challenges for the populations they serve. If risks to customer experience are identified, CSPs proactively employ mitigations that will reduce or eliminate these issues consistent with their assurance levels and risk posture.

The following requirements apply to all CSPs that provide identity services at any IAL:

- The CSP SHALL assess the elements of its identity proofing processes to identify processes or technologies that can result in customer experience challenges, particularly if those challenges prevent the CSP from consistently delivering identity proofing services to all users served by an RP.

- CSPs SHALL provide RPs with a summary of their customer experience assessments that includes information about common challenges or issues faced by users.

- Based on the results of its assessment, the CSP SHALL document any measures it takes to mitigate the possible access challenges.

- The CSP SHALL reassess the customer experience risks periodically and any time the CSP makes changes to its identity service that affect the processes or technologies that impact customer experience.

- The CSP SHALL NOT make applicant participation in these risk assessments mandatory.

General Security Requirements

- Each online transaction within the identity proofing process, including transactions that involve third parties, SHALL occur over an authenticated protected channel.

- The CSP SHALL implement automated attack protections for the identity proofing process, such as bot detection, mitigation, and management solutions; behavioral analytics4; web application firewall settings; and network traffic analysis.

- All personal information that is collected as part of the identity proofing process SHALL be protected to maintain the confidentiality and integrity of the information, including the encryption of data at rest and the exchange of information using authenticated protected channels.

- The CSP SHALL assess the information security and privacy risks associated with operating its identity service, according to the NIST Risk Management Framework [NIST-RMF] or equivalent risk management guidelines. At a minimum, the CSP SHALL apply appropriate controls consistent with the NIST SP 800-53 [SP800-53] moderate baseline, regardless of IAL.

- The CSP SHALL assess risks associated with its use of third-party services and apply appropriate controls, as provided in the [SP800-161] Cybersecurity Supply Chain Risk Management Practices for Systems and Organizations.

Redress Requirements

- The CSP SHALL provide mechanisms for the redress of applicant complaints and problems that arise from the identity proofing process, including proofing failures, delays, difficulties, and the recovery of a compromised subscriber account (e.g., as a result of a scam or fraud).

- These redress mechanisms SHALL be easy for applicants to find and use.

- The CSP SHALL assess the mechanisms for their efficacy in achieving a resolution of complaints or problems.

See Sec. 3.6 of [SP800-63] for more information about redress.

Additional Requirements for Federal Agencies

The following requirements apply to federal agencies, regardless of whether they operate their own identity service or use an external CSP as part of their identity service:

- The agency SHALL consult with their Senior Agency Official for Privacy (SAOP) to determine whether the collection of personal information, including biometrics, to conduct identity proofing triggers Privacy Act requirements.

- The agency SHALL consult with their SAOP to determine whether the collection of personal information, including biometrics, to conduct identity proofing triggers E-Government Act of 2002 [E-Gov] requirements.

- The agency SHALL publish a System of Records Notice (SORN) to cover such collections, as applicable.5

- The agency SHALL publish a Privacy Impact Assessment (PIA) to cover such collections, as applicable.

- The agency SHOULD consult with public affairs and communications professionals within their organization to determine whether a communications or public awareness strategy should be developed to accompany the implementation of any new process or update to an existing process, including requirements associated with identity proofing. Such strategies should consider the use of materials that describe how to use the technology associated with the service, a Frequently Asked Questions (FAQs) page, prerequisites to participate in the identity proofing process (e.g., required evidence), or media (e.g., webinars, live or pre-recorded information sessions) to support adoption of the identity service and provide applicants with a mechanism to communicate questions, issues, and feedback.

- If the agency uses a third-party CSP, the agency SHALL conduct its own PIA and use the CSP’s privacy risk assessment as input.

Requirements for Confirmation Codes

This section includes requirements for CSPs that support the use of confirmation codes.

Confirmation codes are used to confirm that an applicant has access to a postal address, email address, or phone number for the purposes of future communications. Confirmation codes delivered to a postal or phone address can also be used as an identity verification option at IALs 1 and 2, as described in Sec. 4.1.6 and Sec. 4.2.6.

Confirmation codes used for these purposes SHALL include at least 6 decimal digits (or equivalent) from an approved random bit generator (see Sec. 3.2.12 of [SP800-63B]). The confirmation code may be presented as numeric or printable ASCII representation for manual entry, a secure (e.g., https) link containing a representation of the confirmation code, or a machine-readable optical label (e.g., QR code) that contains the confirmation code.

Confirmation codes SHALL be valid for at most:

- 21 days when sent to a validated postal address within the contiguous United States

- 30 days when sent to a validated postal address outside of the contiguous United States

- 10 minutes when sent to a validated telephone number (SMS or voice)

- 24 hours when sent to a validated email address

Upon its use, the CSP SHALL invalidate the confirmation code.

Requirements for Continuation Codes

Continuation codes are used to reestablish an applicant’s linkage to an incomplete identity proofing or enrollment process. The continuation code provides a temporary secret that can connect one session to another. A typical scenario would involve an applicant starting an identity proofing process online (e.g., remote unattended) but needing to complete it through an in-person (e.g., on-site attended) event. This on-site service is often offered by a third party or through a channel that may not have the technology to support authentication of the applicant with established CSP-issued authenticators. If applicants are able to leverage established authenticators at all steps in the identity proofing process, then a continuation code is not needed.

As such, CSPs MAY use continuation codes when an applicant is unable to complete all of the steps necessary to be successfully identity-proofed and enrolled into the CSP’s identity service in a single session, particularly when switching between different identity proofing types. Continuation codes are intended to be maintained offline (e.g., printed or written down) and stored in a secure location by the applicant for use in reestablishing linkage to a previous, incomplete session. In order to facilitate the authentication of the applicant to a subsequent session with the CSP, the CSP SHOULD first bind an authenticator to a record or account that was established for the applicant prior to the cessation of the initial session.

If continuation codes are used, the following requirements apply:

- Continuation codes SHOULD be delivered in-session but MAY be delivered out-of-band to a physical mailing address, phone number, or email address.

- Continuation codes SHALL include at least 64 bits from an approved random bit generator (see Sec. 3.2.12 of [SP800-63B]).

- The continuation code MAY be presented as numeric or printable ASCII representation for manual entry or as a machine-readable optical label (e.g., QR code).

- The verification of continuation codes SHALL be subject to throttling requirements, as provided in Sec. 3.2.2 of [SP800-63B].

- Continuation codes SHALL be stored in hashed form using a Federal Information Processing Standards (FIPS)-approved or NIST-recommended one-way function.

- Upon its use, the CSP SHALL invalidate the continuation code.

Since substantial time may elapse between when an applicant receives their continuation code and when they are able to complete the proofing process, expiry is not defined in these guidelines. This will need to be defined by the CSP based on their processes, technologies, and partnerships.

Requirements for Notifications of Identity Proofing

Notifications of proofing are sent to the applicant’s validated address to inform them that they have been successfully identity-proofed and provide them with information about the identity proofing event and subsequent enrollment. Additionally, the notification explains how the recipient can dispute their involvement in the identity proofing events.

The following requirements apply to notifications of proofing at any IAL:

- SHALL be sent to a validated postal address or phone number at all IALs or MAY be sent to a validated email address at IAL1

- SHALL include details about the identity proofing event, including the name of the identity service and the date on which the identity proofing was completed

- SHALL provide clear instructions, including contact information, on actions for the recipient to take if they repudiate their participation in the identity proofing event

- SHALL provide information about how the organization or CSP protects the security and confidentiality of the information it collects

- SHALL provide information about any responsibilities that the recipient has as a subscriber of the identity service

- SHOULD provide instructions on how to access their subscriber account or information about how the subscriber can update the information contained in that account

If a subscriber repudiates having been identity-proofed by the identity service, the CSP or RP SHALL respond in accordance with its established fraud management and redress policies.

Requirements for the Use of Biometrics

Biometrics refers to the automated recognition of individuals based on their biological and behavioral characteristics, such as facial features, fingerprints, voice patterns, keystroke patterns, angle of holding a smart phone, screen pressure, typing speed, mouse movements, or gait. As used in these guidelines, biometric data refers to any analog or digital representation of biological and behavioral characteristics at any stage of their capture, storage, or processing, including the transmission of biometric data to other applications or service partners. This includes live biometric samples from applicants (e.g., facial images, fingerprint) as well as biometric references obtained from evidence (e.g., facial image on a driver’s license, fingerprint minutiae template on identification cards). As applied to the identity proofing process, CSPs can use biometrics to verify that an individual is the rightful subject of identity evidence, to bind an individual to a new piece of identity evidence or credential, or for the purposes of deduplication. These requirements also address the additional privacy impacts associated with the use of biometrics in the identity proofing process.

The following requirements apply to CSPs that employ biometrics as part of their identity proofing process:

- CSPs SHALL provide clear, publicly available information about all uses of biometrics, including what biometric data is collected, how it is stored and protected, and how to remove biometric data consistent with applicable laws and regulations.

- CSPs SHALL obtain explicit informed consent to collect and use biometrics from all applicants.

- CSPs SHALL store a record of the subscriber’s consent for biometric use and associate it with the subscriber’s account.

- CSPs SHALL have a documented and publicly available deletion process and default retention period for all biometric information. Retention periods SHALL be consistent with applicable regulations, policies, and statutes for the regions and sectors that the CSP serves.

- CSPs SHOULD support the deletion of all of a subscriber’s biometric information upon the subscriber’s request, except where otherwise restricted by regulation, law, or policy. CSPs that do not support biometric deletion requests SHALL publicly document the regulatory, statutory, or risk-based justification for their policy.

- CSPs SHALL have their biometric recognition and attack detection algorithms periodically tested by independent entities (e.g., accredited laboratories or research institutions) for their performance characteristics, including performance across demographic groups. In addition, the CSP SHOULD conduct internal testing on biometric algorithms based on the update schedule of the provider.

- CSPs SHALL assess the performance and demographic impacts of employed biometric technologies in conditions that are substantially similar to the operational environment and user base of the system. The user base is defined by both the expected users and the devices they are expected to use. When such assessments include real-world users, participation by users SHALL be voluntary.

- CSPs SHALL meet the following performance thresholds if one-to-one (1:1) comparison algorithms are used for verification against a claimed identity:

- False match rate: 1:10,000 or better

- False non-match rate: 1:100 or better

- CSPs MAY use one-to-many (1:N) identification in support of resolution or deduplication, pursuant to a privacy risk assessment. In 1:N scenarios, CSPs SHALL meet a minimum performance threshold for false positive identification of 1:1,000 or better.

- A 1:N search of an applicant’s collected biometric characteristics against a database is done to determine whether the applicant is already present in the database, possibly under a different name. The false positive identification rate (FPIR) refers to the proportion of 1:N searches in which a biometric system incorrectly identifies another person as a match, which is a false positive result. The performance metric of 1:1,000 means that a false positive outcome occurs for no more than 1 in every 1,000 searches. Tests that demonstrate this requirement SHALL employ a gallery no smaller than 90 % of the current or intended operational size (N).

- CSPs that make use of 1:N biometric identification for resolution, deduplication, or fraud detection purposes SHALL NOT decline a user’s enrollment without a manual review to confirm the automated search results and confirm that the results are not a false positive identification (e.g., twins submitting face photographs for different accounts with the same CSP).

- Biometric verification technologies SHALL provide performance for applicants of different demographic types that is no more than 25 % worse than the performance for the overall population. For example, if the measured false non-match rate (FNMR) for the overall population is 0.006, the FNMR for a specific demographic group cannot exceed 0.0075. Similarly, if the false match rate (FMR) for the overall population is 0.0001, the FMR for each demographic group cannot exceed 0.000125. The biometric system SHALL be configured with a fixed threshold; it is not feasible to change the threshold for each demographic group. Demographic categories to be considered SHALL include sex, age, and skin tone when these factors affect biometric performance.

- All biometric performance tests SHALL be conformant to ISO/IEC 19795-1:2021 and ISO/IEC 19795-10:2024, including demographics testing.

- CSPs SHALL make the results of their biometric algorithm performance and biometric system operational test results publicly available. The CSP MAY provide these test results in summary form if the results indicate performance against the defined metrics in these guidelines and across the tested demographic groups.

\clearpage

The following requirements apply to CSPs that collect biometric characteristics from applicants:

- CSP SHALL collect biometric characteristics in a way that provides reasonable assurance that the biometric characteristic is collected from the applicant and not another subject.

- When collecting and comparing biometric characteristics remotely, the CSP SHALL implement presentation attack detection (PAD) capabilities that meet the impostor attack presentation accept rate (IAPAR) performance metric of <0.07 to confirm the genuine presence of a live human being and to mitigate spoofing and impersonation attempts. All biometric presentation attack detection tests SHALL be conformant to ISO/IEC 30107-3:2023.

- When collecting biometric characteristics on-site, the CSP SHALL have the operator view the biometric source (e.g., fingers, face) for the presence of unexpected non-natural materials and perform such inspections as part of the proofing process.

Requirements for Visual Facial Image Comparison

Proofing agents and trusted referees that support identity verification will need to be able to compare the facial portraits on presented evidence to the applicant claiming the identity represented in that evidence. As such, when CSPs offer this visual facial image comparison as a verification option, the following requirements apply:

- Proofing agents and trusted referees SHALL be trained to conduct visual facial image comparison. This training SHALL include techniques and methods for identifying facial characteristics, unique traits, and other indicators of matches or non-matches between an applicant and their presented evidence.

- Proofing agents and trusted referees SHALL be assessed on their ability to conduct visual facial image comparisons. Additionally, proofing agents and trusted referees SHALL be reassessed on an annual basis and remedially trained, if needed. Training SHALL be designed to reflect potential real-world attack scenarios, such as comparing applicants to images of relatives, twins, and individuals with a similar appearance.

- CSPs SHALL provide proofing agents and trusted referees that conduct visual facial comparisons during remote attended transactions with resources that support accurate comparisons, such as high-quality image feeds, high-definition monitors, and image analysis software.

- CSPs SHALL document their training and assessment procedures for visual image comparisons and make them available to RPs upon request.

- These requirements SHALL apply for visual facial image comparisons done as manual reviews for failures of automated biometric comparisons (e.g., failure of 1:N checks conducted for resolution or deduplication).

Requirements for the Validation of Physical Evidence

The validation of physical evidence can be conducted by optical capture and inspection (often called document authentication or “doc auth”) or via visual inspection by a trained proofing agent or trusted referee. CSPs can employ either or both processes to evaluate the authenticity of identity evidence.

The following requirements apply to CSPs that employ optical capture and inspection for the purposes of determining document authenticity:

- Automated evidence validation technology SHALL meet the following performance measures:

- If a Machine Readable Zone (MRZ) or barcode is present on the evidence, the optical capture and inspection SHALL compare the MRZ data to the printed data on the evidence for consistency.

- CSPs SHALL implement live capture of documents during the validation process and SHALL implement passive or active document presence checks (also called document liveness). Live capture techniques confirm that the document is physically present and that the image captured during the identity proofing session is not a manipulated digital copy. For additional requirements to prevent the injection of modified media (i.e., digitally generated video or images of evidence), see Sec. 3.14.

- CSPs SHALL assess the performance of employed optical capture and inspection technologies in conditions that are substantially similar to the operational environment and the types of evidence presented by the user base of the system. These tests SHALL account for all available identity evidence types that the CSPs allow to be validated using optical capture and inspection technology. If subscribers’ documents, personal information, or images are used as part of the testing, it SHALL be on a voluntary basis and with subscriber notification and consent.

- CSPs SHOULD have their evidence validation technology periodically tested by independent entities (e.g., accredited laboratories or research institutions) for their performance characteristics.

- CSPs SHALL make the results of their testing publicly available.

These requirements apply to technologies that capture and validate images of physical identity evidence. They do not apply to validation techniques that rely on PKI or other cryptographic technologies that are embedded in the evidence themselves.

The following requirements apply to CSPs that employ visual inspection of evidence by trained proofing agents or trusted referees for the purposes of determining document authenticity:

- Proofing agents and trusted referees SHALL be trained and provided with the resources to visually inspect all forms of evidence supported by the CSP. This training SHALL include:

- Authentic layouts and topography of evidence types

- Physical security features (e.g., raised letters, holographic features, microprinting)

- Techniques for assessing features (e.g., tools to be used, where tactile inspection is needed, manipulation required to view specific features)

- Common indications of tampering (e.g., damage to the lamination, image modification)

- Proofing agents and trusted referees SHALL be assessed regarding their ability to visually inspect evidence based on their training. Additionally, proofing agents and trusted referees SHALL be reassessed on an annual basis or whenever significant new threats to the evidence validation process are identified and remedially trained as needed.

- Proofing agents and trusted referees SHALL be provided with specialized tools and equipment to support the visual inspection of evidence (e.g., magnifiers, ultraviolet lights, barcode readers) as appropriate for the identity evidence type.

- Proofing agents and trusted referees who conduct visual inspections via remote means SHALL be provided with devices and internet connections that support sufficiently high-quality imagery to be able to effectively inspect presented evidence. In these instances, the visual validation SHOULD be supported by automated document validation technologies that provide additional confidence in the authenticity of the evidence (e.g., submitting and validating evidence in advance of an attended remote session).

- CSPs SHALL document their training and assessment procedures for visual inspections of evidence and make them available to RPs upon request.

Due to the potential number and permutations of identity evidence, these guidelines do not attempt to provide a comprehensive list of security features. CSPs need to provide evidence validation training that is specific to the types of identity evidence they accept.

Digital Injection Prevention and Forged Media Detection

Many emerging attacks on both attended and unattended remote identity proofing processes pair digital injection attacks with increasingly effective and available generative AI tools. These AI tools are used to create or modify media that contain images or videos of applicants and evidence (i.e., deepfakes) to defeat automated document validation processes, biometric operations, and visual comparisons done by proofing agents. Injection attacks insert modified or forged media between the capture point (e.g., a device) and the element conducting the comparison or other operation (e.g., a server running the algorithms, a workstation used by a proofing agent).

All types of remote identity proofing are in some way vulnerable to these forms of attack, whether the attack is on the remote optical capture and inspection components, the automated biometric mechanisms, or the video systems used in remote attended processes.

A biometric comparison performed with a captured sample does not prevent these attacks. However, live document capture and presentation attack detection mechanisms do provide some protection from injection and forged media attacks by making the injection of viable forged media more challenging. Not only does the media need to be inserted into the communication channel between the applicant endpoint and the CSP comparison component, but the forged media would also need to sufficiently defeat any passive or active presentation attack detection mechanisms implemented by the CSP. However, even these mechanisms are not sufficient to address all possible cases of these kinds of attacks.

The following requirements apply to all remote identity proofing processes (i.e., unattended and attended) that make use of optical capture and recognition tools for evidence validation, remote biometric capture, and video sessions:

- CSPs SHALL implement technical controls to increase confidence that digital media is being produced by a genuine sensor during the proofing process (e.g., detect the presence of a virtual camera, device emulator, or a jailbroken device).

- CSPs SHALL analyze all digital media submitted during the identity proofing process for artifacts and indicators of potential modification, manipulation, tampering, or forgery. Automated image analysis algorithms SHALL be tested against available attack artifacts (i.e., forged and manipulated images and videos) and genuine media to provide a baseline of performance and to determine the expected rate of false positives and false negatives generated by the system. The kinds of available attack artifacts that were tested and the corresponding false negative rates SHALL be documented and made available to RPs upon request. Algorithmic analysis of media and automated decisioning SHOULD be augmented by manual reviews to address detection errors.

- CSPs SHALL only use authenticated protected channels for the exchange of data during remote identity proofing processes.

- CSPs SHOULD introduce a passive means of detecting forged or manipulated media for all capture scenarios.

- CSPs SHOULD authenticate capture sensors or implement device attestation to increase the confidence in a device being used to transmit digital media as part of a remote identity proofing process.

- CSPs SHOULD analyze digital media for signatures of generative AI algorithms and deepfake tools that are known to be used to create forged digital media.

The following additional requirements apply to remote attended collection scenarios:

- CSPs SHALL train proofing agents and trusted referees to look for indications of manipulated media (e.g., high latency, synchronization issues, inconsistent skin tone and resolution).

- CSPs SHALL introduce random “human-in-the-loop” cues into their capture processes to increase the possibility of forged or manipulated media being detected (e.g., by requesting user movements or requesting that the user move objects between the capture sensor and their face).

Exception and Error Handling