Energy Escalation Rate Calculator (EERC)

User Guide

Summary

EERC computes an average rate of escalation for a specified time period, which can be used as an escalation rate for contract payments in ESPCs and UESCs. These escalation rates are based on energy price projections from the Department of Energy’s Energy Information Administration (EIA). While the underlying energy price projections vary from year to year, for calculating contract payments the single EERC-calculated uniform average rate is preferable. The rate is stated in real (excluding inflation) and nominal (including inflation) terms and weighted by the share of each of the energy types used in the project. Alternatively, an escalation rate for each energy type can be computed separately.

To assist federal agencies (and others) in considering a range of energy price and policy scenarios, escalation rates may be adjusted by NIST for three levels of estimated social cost of carbon (SCC).

The EIA projections adjusted by NIST for carbon pricing are based on three SCC projections provided in the Interagency Working Group on Social Cost of Greenhouse Gases Interim Estimates, which were developed pursuant to Executive Order 13990. Those estimates are adjusted by NIST to 2023 dollars. The scenarios assume different discount rates and projection percentile, providing a range of values that can be used for sensitivity analysis. Note that this approach was implemented in the 2023 release, replacing the previous methodology that used carbon pricing projections based on proposed carbon cap-and-trade legislation from 2009.

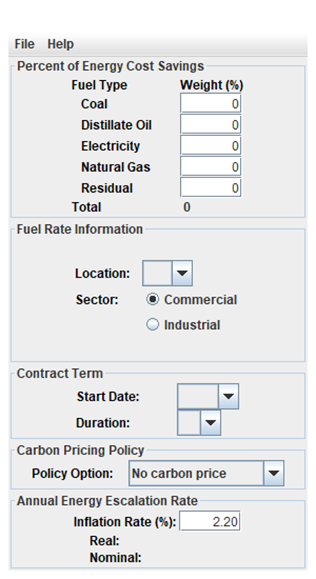

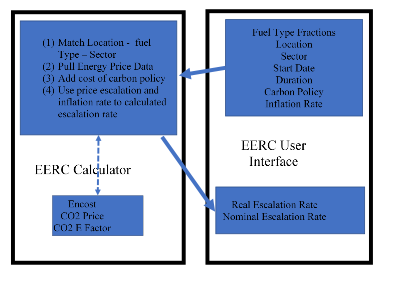

The prior (executeable) user interface is shown below (left). The user provides the fuel type, fuel rate, study period, carbon pricing scenario, and inflation rate. Default values are provided for projected SCC scenarios (SCC of zero) and inflation rate (based on annual supplement value). The discount rate is fixed based on the Annual Supplement. The output is a real escalation rate and nominal escalation rate values. The flow diagram for the EERC workflow including the required data is shown below (right).

Inputs and Outputs

EERC prompts the user for information on the share of cost savings attributable to each fuel type, the project location, industry sector, and beginning date and duration of the project term. It also prompts the user to select one of several estimated SCC scenarios -- no SCC, low, medium, or high -- then retrieves the relevant energy price forecasts and computes the average escalation rate, as described above. Since the performance period generally begins a year or more later than the contract award date, the calculated average rate includes the price escalation for the intervening year(s). Escalation is assumed to take place during this period.

The calculated average escalation rate is reported in both real (excluding inflation) and nominal (including inflation) terms. The energy price projections for all scenarios exclude inflation and thus generate real rates. The default inflation rate used in the EERC is the long-term inflation rate calculated annually by DOE/FEMP using the average annual inflation estimates for the next 10 years from the White House Council of Economic Advisors (CEA) Analytical Perspectives and the methodology described in 10 CFR 436, but without consideration of the 3.0 % floor for the real discount rate. The default inflation rate does not account for the discount rate floor to accommodate the need for market-based projections of future energy prices in contract negotiations. Otherwise, the default inflation rate would be artificially low in years when the 3.0 % floor applies.

Inputs

Percent of Energy Cost Savings:

- Percentage of energy cost savings in dollars that is attributable to one or more of the fuel types used in the project. This input is used to weight the escalation rate.

- Default values are zeros

- Inputted values must sum to 100%

Fuel Rate Information:

- Location: Selection of the state in which the project is located allows the program to select the energy price escalation rates for the corresponding census region.

- Sector: Selection of commercial or industrial sector determines the type of utility rate schedule applied to the energy cost calculation.

- User must make a selection of both inputs

Contract Term:

- Start Date: Year of contract award/signing.

o User must select a start date year

o Options are limited to the next 3 years

- Years Duration: Number of years of the contract term.

o User must make a selection for the duration

o The duration is limited between 10 years and 25 years

Social Cost of Carbon (SCC)

Assumptions:

Selection of one of the following carbon pricing scenarios:

- No SCC - $0

- Assumes that SCC is zero for the entire contract term

- Uses annual energy price forecasts of the Energy Information Administration, which do not account for estimated SCC

- Low - $18 in 2023

- Average SCC assuming a 5 % discount rate (i.e., 5 % DR (and average assumption of estimated carbon damages))

- SCC starts at $18 in 2023 and increases over time

o Lower SCC values than with a 3 % DR because future values have a lower present value than in the Medium case

- Medium - $61 in 2023

- Average SCC assuming a 3 % discount rate (i.e., 3 % DR (and average assumption of estimated carbon damages))

- SCC starts at $61 in 2023 and increases over time

- Represents the assumptions that best align with the DOE and OMB discount rates

- High - $183 in 2023

- 95th percentile SCC assuming a 3 % discount rate (i.e., 3 % DR (95th percentile of estimated carbon damages))

- SCC starts at $183 in 2023 and increases over time

o Higher SCC values than with 3 % DR average because the estimated damages are greater (95th percentile) than in the Medium case (50th percentile)

Annual Inflation Rate:

The default rate of inflation is the long-term inflation rate calculated annually by DOE/FEMP using CEA data and the method described in 10 CFR 436, but without consideration of the 3.0 % floor for the real discount rate. The default inflation rate does not account for the discount rate floor to accommodate the need for market-based projections of future energy prices in contract negotiations. Otherwise, the default inflation rate would be artificially low in years when the 3.0 % floor applies. The inflation rate may be edited.

- The tool makes all the calculations using the default inflation rate

- If the user decides to change the inflation rate, the calculations should be re-created.

Output - Annual Energy Escalation Rates:

- Real and Nominal Escalation Rates: The output of the program is the calculated average escalation rate, stated both in real terms (excluding the rate of inflation) and in nominal terms (including the rate of inflation).

Functions

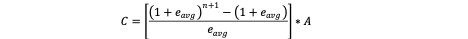

To calculate the nominal escalation rate, which includes inflation, the calculator uses the following relationship:

![]()

The calculated average annual escalation rate, eavg, when applied to the base-year energy costs or savings of ESPC or UESC projects, results in approximately the same undiscounted total amounts over the performance period as do the EIA-projected, or adjusted EIA-projected, variable rates. If more than one fuel is used in the project, the EERC weights the average escalation rate according to the proportions stated by the user.

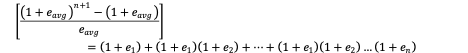

To compute an average annual escalation rate, base-year (i.e., award year) energy costs are escalated from year to year at rates projected by EIA, or at EIA rates adjusted by NIST for carbon pricing, to arrive at the total energy cost over a given performance period. The escalation rates, e, are projected by census region, energy type, and industrial sector and vary from year to year. The formula used EERC prompts the user for information on the share of cost savings attributable to each fuel type, project location, industry sector, and the beginning date and duration of the performance period. It also prompts the user to select one of several carbon pricing scenarios -- no carbon pricing, low, medium, or high --then retrieves the relevant energy price forecasts and computes the average escalation rate, as described above. Since the performance period begins later than the base date, the calculated average rate includes the price escalation for the intervening year(s).

to calculate total energy costs is:

![]()

where

C is the undiscounted total of future energy costs over the performance period

A is the base-year annual cost

ei is the annual escalation rate, which varies from year to year over the performance period

n is the number of years in the performance period

When the escalation rate is the same in each year of the study period, the series can be simplified to a factor applied to the base-year annual cost, A:

where eavg is the average annual escalation rate

Since a uniform escalation rate is needed to compute the contract payments in ESPC and UESC projects, the EERC uses this equation to approximate C, as calculated with EIA rates or adjusted EIA rates, and iteratively solves for eavg, the average annual escalation rate. The relationship between the factor calculated in the equation and the variable escalation rates in the series can be expressed as follows for a performance period of n years duration:

The cost of carbon is calculated using the emissions per unit of fuel type, the SCC projections, and the carbon emissions factor to calculate a price per unit of fuel. Then its added into the projected energy prices before the escalation rate is calculated.

For electricity, take the baseline CO2e emissions rate for a state and create the emissions rate for each year by multiplying it by the emission factor for that state (fraction of baseline emissions rate by year). This value is then multiplied by the SCC from the projected SCC scenario by year. This provides the carbon price per unit of electricity.

The CO2e emissions rates for other fuels (distillate oil, residual oil, nat gas, LPG, and coal) are based on EPA’s relevant emissions hub. These rates do not change by year. Therefore, the emissions per unit are constant over time.

The energy price is adjusted by the cost of carbon per unit of fuel (assuming a 100% pass-through to the retail price). This is added before the escalation rates are calculated so that the escalation rates are appropriated adjusted for the carbon scenario.

The purpose of including the carbon cost is to adjust future energy prices to incorporate the social cost of carbon. Current energy prices have not internalized any of these external costs. Therefore, it is not appropriate to add the price of carbon to the base year energy prices. Instead, the addition of carbon to energy prices initially occurs for every year after the base year, similar to what would happen to energy prices if legislation were to require energy producers to pay the estimated social cost of carbon on their production starting at the end of the base year. Alternatively, you could think of it as a federal agency deciding to start including the social cost of carbon into the costs considered for future energy consumption. The exceptions are California and the 12 northeastern states that are part of the Regional Greenhouse Gas Initiative (RGGI), which each have a carbon market with average carbon prices of approximately $34 and $14 at the most recent auctions, respectively, at release of this document.

Data Tables

The data tables include

1. the Encost file that includes the EIA energy price projections for each fuel type over time

o This file is provided by EIA and then NIST manipulates it to create the annual supplement data

2. CO2 Price file that includes the projected prices for CO2e emissions

o Provided by scenario and year

3. CO2 Future Emissions file that includes the projected emissions rate factors for electricity generation over time

o Fraction of Current Year’s Emissions Rate by state

4. CO2 Factors file that includes the baseline emissions rates for electricity and other fuel types

o Electricity emission rates are provided by state

o Other fuel types are assumed to be constant using a national average rate

These data tables are called on by the code, will stay constant over time in term of format, but the data is updated annually.